Why Business Valuation Important?

- Mergers and Acquisitions

- Investment Decisions

- Fundraising and Financing

- Strategic Planning

- Exit Strategy

- Financial Reporting

- Litigation and Disputes

- Risk Assessment

- Improving Performance

- Tax Planning

- Regulatory Compliance

Factors Influencing Business Valuation

Several factors impact the valuation of a business in India. These include:

- Market demand

- Competitive landscape

- Growth potential

- Financial performance

- Industry regulations

Business Valuation – Trends & Challenges

Emerging trends

The field of business valuation in India is witnessing some exciting trends such as

- Growing importance of intangible assets,

- Rise of start-up valuations,

- Adoption of technology driven valuation methods, and

- Impact of global market dynamics on valuations.

Challenges

Business valuation in India comes with its fair share of challenges. These include

- Lack of standardized methodologies,

- Subjectivity in valuation,

- Information gaps, and

- Changing regulatory environment.

Business Valuation Approaches

INCOME APPROACH

- The Income Approach provides an indication of value by converting future cash flow to single current value.

- Under the Income Approach, the value of an asset is determined by reference to the value of income, cash flow or cost savings generated by the asset.

COST APPROACH

- The Cost Approach provides an indication of value using the economic principle that a buyer will pay no more for an asset than the cost to obtain an asset of equal utility, whether by purchase or by construction, unless undue time, inconvenience, risk or other factors are involved.

- The approach provides an indication of value by calculating the current replacement or reproduction cost of an asset and making deductions for physical deterioration and all other relevant forms of obsolescence.

MARKET APPROACH

- The Market Approach provides an indication of value by comparing the asset with identical or comparable (that is similar) assets for which price information is available.

BusinessValuation Methods

Business Valuation methods are

- Discounted cash flow (DCF) analysis

- Comparable company analysis

- Precedent transactions analysis

This are the essential methods for determining the worth of a business.

These techniques consider factors:

1. Growth prospects

2. Market conditions

3. Industry trends

to estimate the fair value of a company. By understanding these valuation methods, which helps to make informed investment decisions and negotiate favourable deals.

Evolution In Business Valuation

Evolution from simple rule-of-thumb methods to sophisticated, data-driven approaches.

Advanced technologies like AI and ML enhancing accuracy and efficiency.

Real-time data integration for dynamic valuation models.

Inclusion of ESG factors and intangible assets in valuations.

Scenario analysis and stress testing for risk assessment.

Use of alternative data sources for additional insights.

Standardization and transparency in valuation methodologies.

Collaborative approach involving stakeholders from various fields.

Growing importance of intangible assets in valuation.

Consistent and reliable valuation standards across jurisdictions.

Increased demand for sophisticated valuation methods in private equity and venture capital.

Reasons for Increasing Trends In Business Valuation

Increased Use of Technology

Focus on Intangible Assets

Shift Towards Real-Time Valuations

Rise of Private Equity Valuations

Cross-Border Transactions

Alternative Investment Valuations

Sustainability and ESG Factors

Post-Pandemic Impact

Regulatory Changes

We provide following services:

- Business Valuations

- Intangible Assets Valuation

- Corporate Valuations for Mergers & Acquisitions

- Options Valuations

- Valuation for Foreign Investments

- Start-up Valuations

- Tangible Asset Valuations

- Convertible Instruments Valuations

- Valuation for Tax Compliances

- Valuations under Dispute Resolutions

- IFRS Valuations

- Transaction Support - Due Diligence, Tax, Legal Support

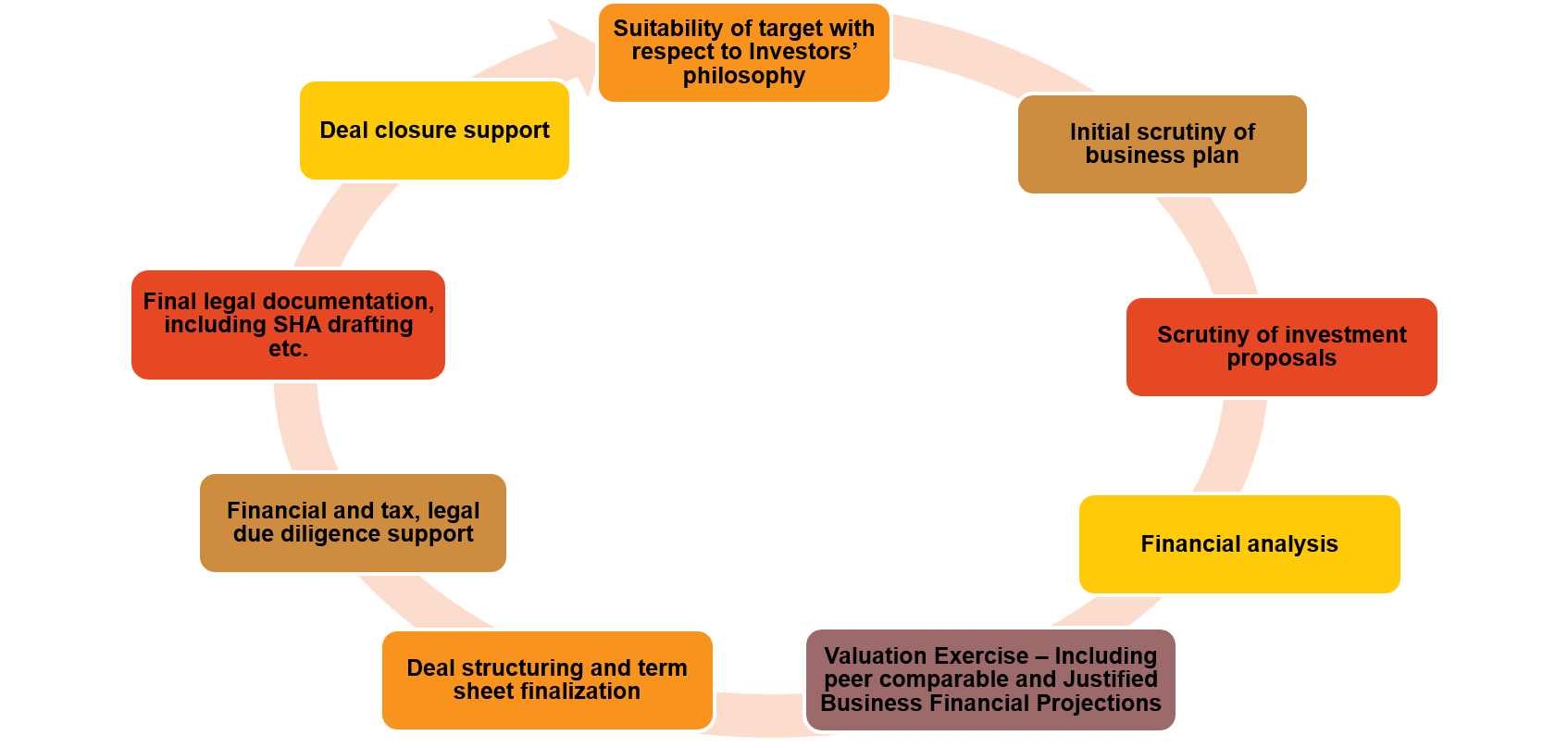

OUR SERVICES TO INVESTORS