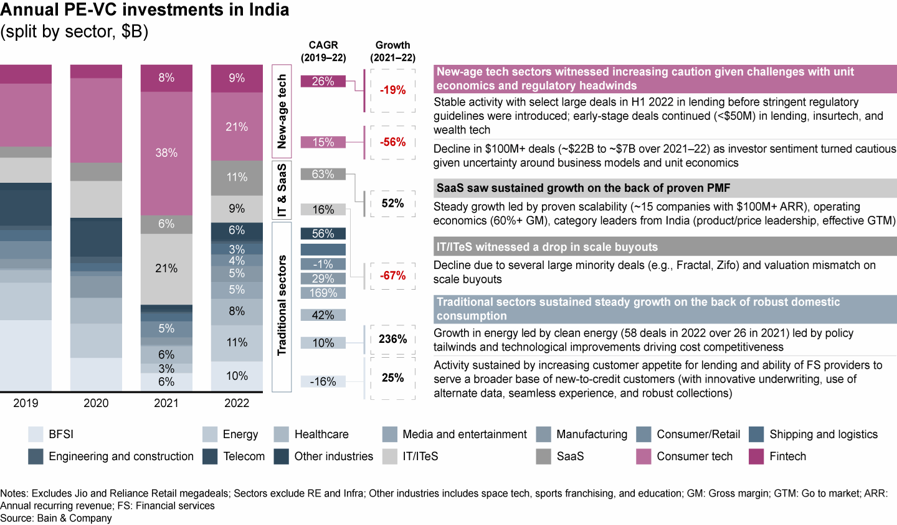

Sectors In which Equity Funding Increased

Technology

Healthcare

FinTech

Defence

Food

EV

Commerce

Key Drivers of Equity Investments

- Increased funding for startups across various sectors

- Rise of unicorn companies (startups valued at $1 billion or more)

- Growing interest from foreign investors

- Fintech and e-commerce sectors dominate equity funding

- Government initiatives to support startups and attract investments

- Rapid digital adoption and increased internet penetration driving investments

- Secondary market activity with investors buying and selling shares of private companies

- Established companies actively raising funds through IPOS and follow-on offerings

- Focus on social impact and sustainability leading to funding in sectors like renewable energy, healthcare, and education

LATEST EQUITY FUNDING TRENDS IN INDIA

LATEST EQUITY FUNDING TRENDS IN INDIA

PE/VC investments in April 2023 reached US$7.4 billion, a 1% increase compared to April 2022 (US$7.3 billion) and a significant 37% increase from March 2023.

The number of deals in April 2023 saw a 55% year-on-year decline and a 32% sequential decline.

Pureplay PE/VC investments amounted to US$4.4 billion across 49 deals, experiencing a 22% decrease in value and a 55% decrease in volume compared to the previous year.

Infrastructure and real estate recorded US$3 billion in PE/VC investments, marking an 82% year-on-year increase and a 3% increase over March 2023.

Growth investments were the highest in value in April 2023, totaling US$4.5 billion across 12 deals, a 9% decline compared to April 2022.

PIPE investments witnessed substantial growth, reaching US$1.2 billion across four deals, a six-fold increase year-on-year in terms of value.

Startup investments in April 2023 amounted to US$676 million across 36 deals, a decrease from US$1.8 billion across 86 deals in April 2022.

The infrastructure sector was the top performer in April 2023, driven by large deals in the renewables space, recording US$3 billion in PE/VC investments across 10 deals.

Infrastructure and real estate recorded US$3 billion in PE/VC investments, marking an 82% year-on-year increase and a 3% increase over March 2023.

Healthcare was the second-largest sector, with US$2.6 billion across six deals, primarily due to a single large deal. Other sectors like technology, e-commerce, financial services, and media and entertainment witnessed over a 50% decline in PE/VC investment value.

LATEST EQUITY FUNDING TRENDS IN INDIA

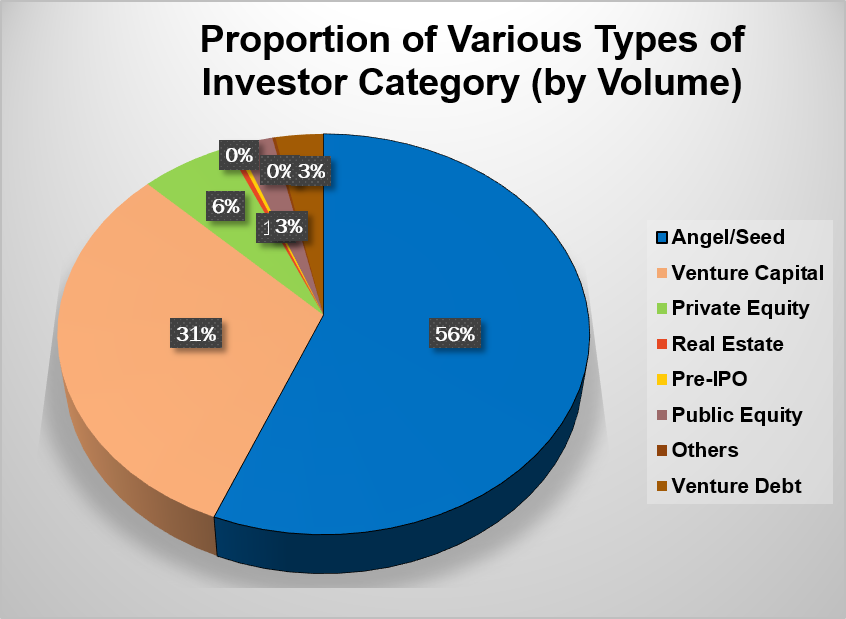

Equity Funding & Investors

Angel investing and venture capital funding are surging in the Indian equity funding landscape, supporting early-stage startups.

Crowdfunding platforms are gaining popularity, allowing individuals to invest in promising ventures.

Impact investing is on the rise, with investors seeking both financial returns and positive social or environmental impact.

Equity funding has become a vital source of capital for startups in India, fostering a thriving ecosystem.

Diverse funding options offer opportunities but require entrepreneurs and investors to navigate challenges.

Understanding dynamics and staying updated with trends helps stakeholders make informed decisions.

Contributing to the growth of India’s equity funding landscape requires seizing opportunities and addressing challenges.

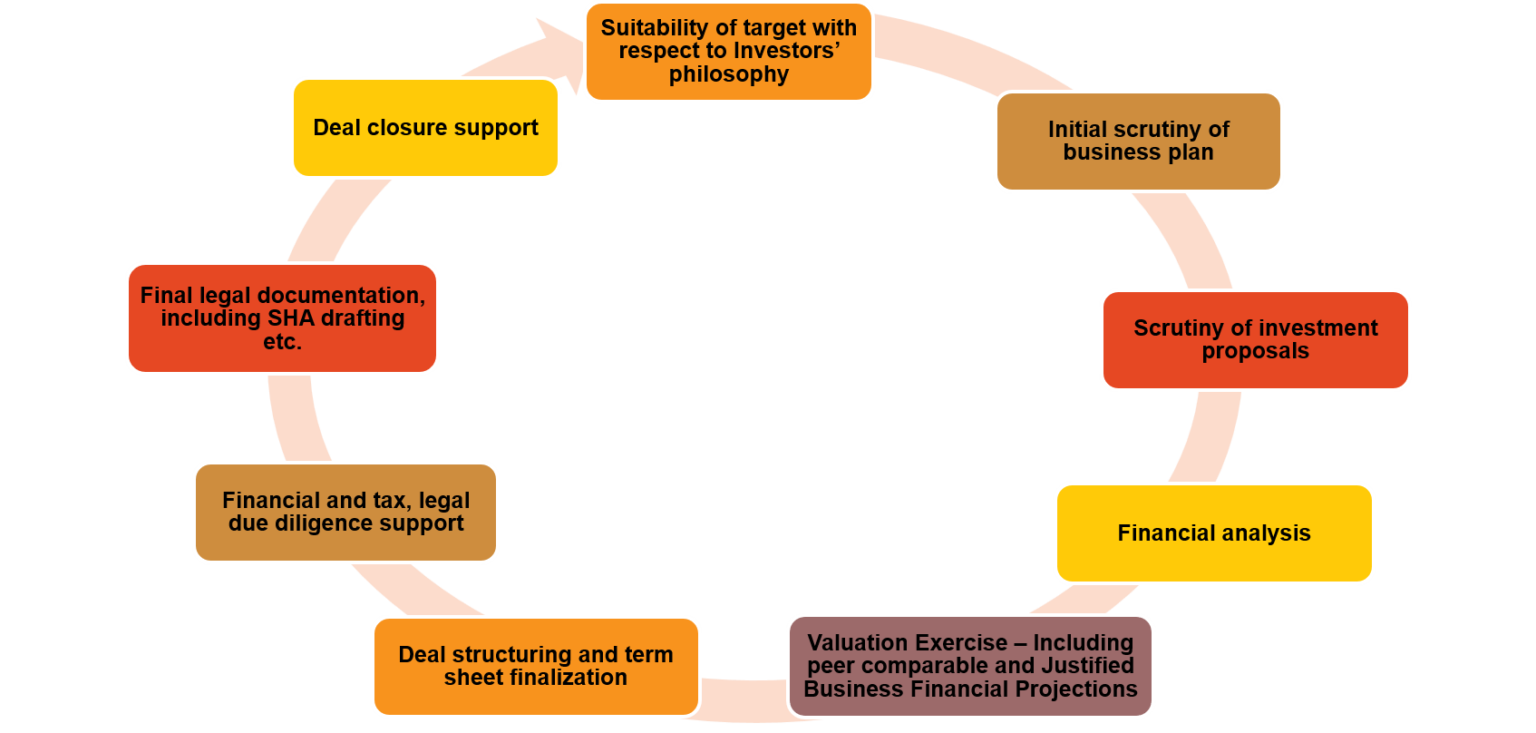

We provide following services:

- Business Valuations

- Intangible Assets Valuation

- Corporate Valuations for Mergers & Acquisitions

- Options Valuations

- Valuation for Foreign Investments

- Start-up Valuations

- Tangible Asset Valuations

- Convertible Instruments Valuations

- Valuation for Tax Compliances

- Valuations under Dispute Resolutions

- IFRS Valuations

- Transaction Support - Due Diligence, Tax, Legal Support

Industries We Serve

EV, Automobile ancillaries & vehicle dealers

Real Estate & Infra

IT & ITES

Financial Services

Manufacturing companies

Aartificial Intelligence, Robotics Co, Crypto

Gold

Healthcare industries

Aerospace & Defense

Hospitality & Catering Companies

Engineering

Bio-pharma Companies

OUR SERVICES TO INVESTORS